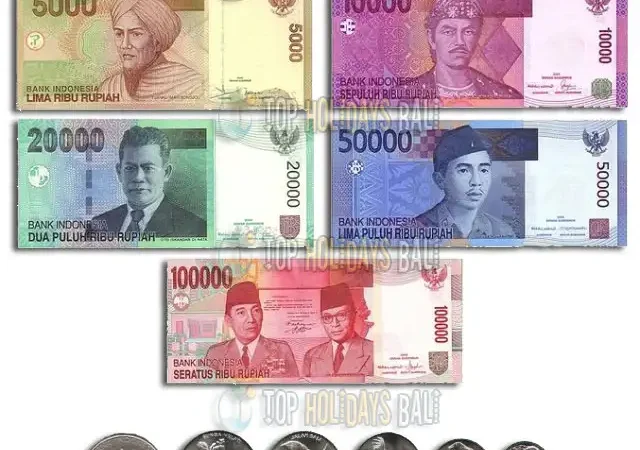

Currency of Indonesia:

The Indonesian Rupiah, abbreviated IDR and denoted by the symbol “Rp,” is the country’s official currency. The official and legal money used in Indonesia for daily business and financial transactions is the Indonesian Rupiah.

Please be aware that exchange rates can change, so if you’re going to travel to Indonesia or conduct any financial operations involving Indonesian currency, it’s best to check the most recent rates.

How do you write Indonesia currency?

The Indonesian Rupiah, sometimes known as “IDR” (which stands for “Indonesian Rupiah”), is the country’s official currency. The Indonesian Rupiah is denoted by the letter “Rp.”

When writing or expressing amounts in Indonesian Rupiah, it is common to place the symbol “Rp” before the numerical value. For example:

- Rp 100,000 (one hundred thousand Indonesian Rupiah)

- Rp 500,000 (five hundred thousand Indonesian Rupiah)

- Rp 1,000,000 (one million Indonesian Rupiah)

In common usage, amounts may also be written using just the numeric value rather than the “Rp” symbol. For illustration:

- 100,000 (one hundred thousand Indonesian Rupiah)

- 500,000 (five hundred thousand Indonesian Rupiah)

- 1,000,000 (one million Indonesian Rupiah)

When dealing with monetary transactions in Indonesia, it’s crucial to use the proper currency symbol or abbreviation to prevent confusion.

It is advised to consult a dependable financial news source, a financial institution, or a reputable currency exchange platform for the most current and correct value of the Indonesian Rupiah in relation to other currencies, such as the US Dollar (USD), Euro (EUR), British Pound (GBP), etc. These resources offer exchange rates that are current or almost current, enabling you to compare the Indonesian Rupiah’s value to other significant currencies.

Advantages and Disadvantages:

For the Indonesian economy, as well as for individuals living in the nation and those interacting with the currency, the Indonesian Rupiah (IDR) has its own unique mix of benefits and drawbacks. Here is a quick summary:

Advantages:

- National Sovereignty: Indonesia can autonomously handle its own fiscal issues since it has control over its monetary policy and economic stability thanks to having a national currency.

- Exchange Rate Flexibility: A flexible exchange rate can aid in economic shock adjustment, stabilize the economy, and sustain global competitiveness.

- Facilitating Trade and Tourism: Trade is made easier for businesses and visitors to conduct both locally and globally when the national currency is stable and widely accepted.

- Central Bank Control: The Bank of Indonesia can use monetary policy tools to control the money supply, interest rates, and inflation in order to affect the stability and direction of the economy.

- Ease of Transactions: The Indonesian Rupiah is widely used throughout the nation, simplifying transactions and lowering the frequency of currency conversions.

- Local Economy Support: Utilizing the local currency stimulates domestic trade and investment as well as local company support.

Disadvantages:

- Exchange Rate Volatility: International exchange rates are prone to change, which can have an impact on the purchasing power of the Indonesian Rupiah and on global trade.

- Inflation Risk: Over time, high inflation rates can devalue the Rupiah, raising living expenses and lowering the currency’s purchasing power.

- Dependence on Global Economy: As a developing nation, Indonesia’s economy is susceptible to fluctuations in market sentiment and global economic conditions, which can have a considerable impact on the value of the Rupiah.

- Foreign Exchange Reserves: To support the value of the Rupiah and manage its stability against major international currencies, it is essential to maintain enough foreign exchange reserves.

- Currency Speculation: Economic stability may be impacted by short-term volatility in the value of the Rupiah as a result of speculative operations in the foreign currency market.

- Impact on Imports and Debt: The nation’s trade balance may be impacted by a weaker Rupiah, and debt repayment in foreign currencies may be impacted as well.

It’s vital to remember that differing viewpoints, economic circumstances, and governmental regulations can all affect how benefits and disadvantages are seen. To maximize the advantages of a national currency while minimizing potential drawbacks, a balanced strategy for controlling the value of the currency and fostering economic stability is required.

Indonesia Currency value:

The value of the Indonesian Rupiah (IDR) in relation to other currencies can change as a result of a number of variables, such as monetary policies, trade balances, geopolitical events, and economic conditions. Foreign exchange markets have an impact on exchange rates, which are dynamic. Please be aware that exchange rates can change, so if you’re going to travel to Indonesia or conduct any financial operations involving Indonesian currency, it’s best to check the most recent rates.

It is advised to consult a dependable financial news source, a financial institution, or a reputable currency exchange platform for the most current and correct value of the Indonesian Rupiah in relation to other currencies, such as the US Dollar (USD), Euro (EUR), British Pound (GBP), etc. These resources offer exchange rates that are current or almost current, enabling you to compare the Indonesian Rupiah’s value to other significant currencies.

Thanks.