Introduction:

A country’s economic history, cultural identity, and financial strength are all reflected in its currency, which serves as more than just a medium of commerce. The national currency of Indonesia is the Rupiah (IDR), which carries a complex web of cultural symbols, economic narratives, and difficulties. This article explores the complex world of Indonesian money, including its historical development, cultural importance, economic difficulties, and the influence of digital currencies on the country’s financial system.

Historical Evolution of the Rupiah:

The Dutch East Indies Guilder was the official currency during the Dutch colonial era, which is when the history of the Indonesian currency began. The Indonesian Rupiah was established in 1949 as a result of many currency adjustments that followed Indonesia’s declaration of independence in 1945. Several denominations of the Rupiah were carried out, most notably in 1965 and 1970, in an effort to reduce hyperinflation and streamline transactions.

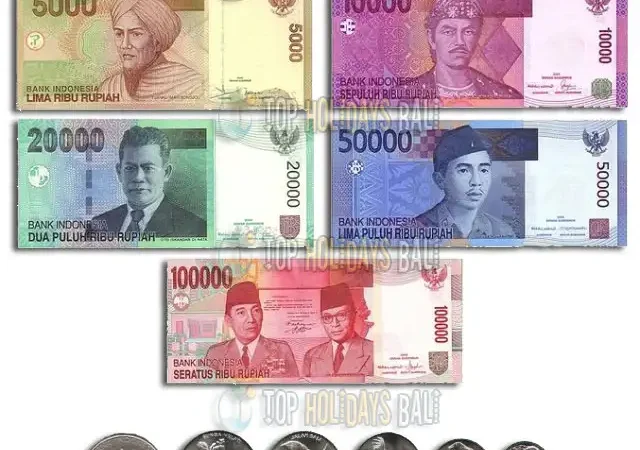

Cultural Symbols on Banknotes:

Indonesia’s banknotes are canvases that showcase the country’s vast cultural variety in addition to being functional objects. Every religion has recognizable people, scenes, and symbols with cultural and historical meaning. The design frequently incorporates the national slogan, “Bhinneka Tunggal Ika” (Unity in Diversity), which highlights Indonesia’s dedication to honoring its diverse cultures under a single national identity.

Economic Challenges:

Over the years, the Rupiah has had economic difficulties despite its cultural value. Indonesia has experienced problems with depreciating currency, inflation, and unstable economic conditions. External causes that have frequently put pressure on the Rupiah include geopolitical events and volatility in the world economy. The nation’s reaction to these difficulties, which included monetary policy and central bank initiatives, has been essential in keeping the value of the currency stable.

Impact of Inflation on the Rupiah:

The Indonesian economy has frequently struggled with inflation, which affects the Rupiah’s buying power. To control inflation, the government works with Bank Indonesia, the country’s central bank, to pursue a number of initiatives. These include managing the money supply, addressing external economic issues, and enacting conservative fiscal policies. The Rupiah’s value and a stable economic climate are the two goals of these initiatives.

Rupiah as a Cultural Artifact:

The Rupiah represents Indonesia’s rich cultural legacy in addition to its economic significance. The images and symbols on the banknotes, which frequently include famous sites, customary rituals, and national heroes, promote a sense of pride and unanimity among Indonesians. In this sense, the money takes on the physical form of a tangible symbol of the history and identity of the country.

Financial Inclusion and Digital Currencies:

With an increasing focus on financial inclusion, digital financial services have seen a boom in Indonesia in recent years. The emergence of digital wallets, mobile banking, and electronic payment methods has revolutionized Indonesians’ financial practices. Given the advantages that digital currencies can provide in terms of efficiency, transparency, and financial access, the government has also indicated interest in investigating the possibilities of these technologies.

Challenges and Opportunities in Digital Currency Adoption:

Adoption of digital currencies provides obstacles as well as possibilities for technical development and financial inclusivity. It is important to give considerable thought to issues related to cybersecurity, regulatory frameworks, and the possible influence on conventional banking systems. For legislators and financial institutions, finding a balance between welcoming innovation and maintaining the security and stability of the financial ecosystem is crucial.

The Role of Blockchain and Cryptocurrencies:

Blockchain, the underlying technology powering digital currencies, has attracted a lot of attention due to its potential to completely transform financial activities. Worldwide interest in cryptocurrencies, like Bitcoin and Ethereum, is growing, and Indonesia is not an exception. The government has begun investigating cryptocurrency legislation, realizing that a framework that guarantees financial integrity and innovation is necessary.

Economic Outlook and Currency Resilience:

The stability of the Rupiah continues to be a major worry as Indonesia negotiates the challenges of a globalized economy and the digital revolution of financial services. The security and strength of the national currency will be largely dependent on the government’s commitment to strong economic policies, financial inclusion programs, and adoption of digital advancements.

Conclusion:

With its rich cultural connotation, turbulent history, and present economic difficulties, the Rupiah is more than simply a tool for trade in Indonesia. It reflects the spirit, resiliency, and progress aspirations of the country. Indonesia must balance protecting the value of its conventional currency with seizing the potential given by digital currencies as the globe moves closer to a digital economy. Both in hard copy and digital format, the Rupiah will always be a vibrant representation of Indonesia’s thriving economy and diverse culture.