Introduction:

Exchange charges have a primary effect on how worldwide change and funding are not unusual inside the interconnected worldwide economic system. These exchange fees, which show how a great deal one forex is properly well well worth almost approximately every other, have an effect on countrywide competitiveness, the charge of products, and the desirability of overseas funding. Comprehending the complicated dance of forex costs is crucial for traders, governments, and agencies. We will test the complex relationships among remote places cash charges and foreign funding and trade in this weblog post, in addition to the following strategic troubles and underlying mechanisms.

Understanding Exchange Rates:

Definition and Basics:

The charge of one foreign exchange at the problem of every distinctive is represented thru exchange costs. They are said as pairs of currencies, wherein USD/EUR denotes the cost of one US dollar in euros. The foreign exchange market (Forex), wherein currencies are offered and traded, units alternate expenses.

Factors Influencing Exchange Rates:

Exchange expenses are stimulated with the aid of using manner of some of variables, which incorporates marketplace temper, political stability, inflation, interest prices, and financial signs and signs. Exchange charge fluctuations within the the Forex market market are in elegant because of deliver and get in touch with for.

Impact on International Trade:

Price Competitiveness:

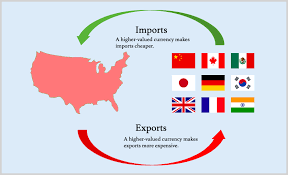

In global marketplaces, trade fees have a right away effect at the charge of products and services. A united states of america’s exports are more low price in out of doors markets at the same time as its distant places cash is lower, which may also increase export volumes. On the possibility hand, a stronger overseas coins would possibly growth the rate of exports and so lessen competitiveness.

Trade Balances:

Exchange expenses impact import and export volumes, which in turn affects a rustic’s change stability. By making exports extra reasonably-priced and imports extra high priced, a country’s change balance can be superior thru a overseas cash depreciation, which may also moreover assist to shut exchange imbalances.

Currency Hedging:

Currency hedging is a commonplace technique used by groups concerned in worldwide trade to reduce the risks delivered on by manner of versions in change fees. By allowing groups to fasten in alternate charges, in advance contracts and alternatives help them reduce their exposure to forex volatility and provide financial making plans a high-quality diploma of predictability.

Impact on International Investment:

Foreign Direct Investment (FDI):

The desirability of a rustic as a area for foreign direct funding is inspired through change fees. A kingdom might also lure extra global buyers if its currency is robust and strong, however a volatile or prone forex might also additionally purpose investors to fear approximately possible declines in funding returns.

Portfolio Investment:

Financial market investors are liable to changes in trade prices. Variations have the capability to have an impact on the returns on overseas funding portfolios, because of this affecting asset allocation techniques and funding alternatives.

Repatriation of Profits:

Exchange charges have an effect on how profits are repatriated for worldwide groups. Profits may be extended via a good alternate charge at the time of repatriation, at the identical time as returns on remote places belongings can be reduced through an adverse price.

Strategic Considerations:

Central Bank Interventions:

In order to govern or stabilize trade expenses, essential banks often become concerned in the foreign cash market. Central banks have the capability to influence the fee in their foreign places coins through the usage of monetary policy devices like quantitative easing and interest rate changes.

Trade Agreements and Tariffs:

Tariffs and alternate agreements have an oblique impact on foreign exchange charges. Trade agreements and charge lists may additionally have an effect on a country’s trade balance, which in turn may also need to have an effect at the value of that state’s foreign money.

Global Economic Conditions:

An crucial thing influencing trade price fluctuations is the overall state of the economic system. The volatility of foreign cash markets can be encouraged with the resource of global uncertainty, geopolitical occasions, and monetary statistics, which in turn will have an impact at the hazard urge for meals of agencies and consumers.

Conclusion:

The unseen strands that affect alternate, funding, and financial stability in the course of the world financial tool are alternate prices. Exchange rate effects on distant places investment and trade are difficult and multidimensional, necessitating a complicated keep close to of market, political, and economic factors. It is crucial for organizations worried in international exchange similarly to consumers navigating overseas markets to preserve track of modifications in overseas coins expenses and located threat-reduction techniques into movement.