How can get new currency in Pakistan?

In Pakistan, you normally buy coins and banknotes through approved financial organizations, such as banks and exchange bureaus, if you’re trying to buy fresh money. The procedures you can take to obtain fresh cash in Pakistan are as follows:

- Visit a Bank: Visit a nearby branch of a bank. In Pakistan, most banks provide currency exchange services. You may trade in your old money for brand-new coins and banknotes.

- Currency Exchange Bureaus: Additionally, you can go to approved currency exchange offices. They have a focus on currency exchange and could provide you the new currency.

- Use ATMs: If you have a bank account in Pakistan, you may use an ATM to get banknotes representing the local currency. The most prevalent denominations are provided via ATMs.

- Contact the State Bank of Pakistan: You can get advice or authorisation from the State Bank of Pakistan (SBP) if you have unique needs or require a sizable sum of additional money.

- Currency Dealers: In some instances, if you need help with a big quantity or a specific denomination, you might wish to get in touch with a licensed currency dealer.

- Currency Exchanges at Airports: You may often exchange your foreign cash for Pakistani Rupees at the airport if you are traveling to Pakistan from another nation.

- Online Banking: You might be able to order fresh banknotes using your bank’s online platform and have them delivered to your location if you have access to internet banking.

To prevent any possible problems with fraud or fake cash, it is crucial to make sure you are working with reliable, approved organizations. Always be sure the bank or exchange bureau you select for currency exchange is legitimate.

Advantages and Disadvantages:

Introducing new money might have benefits and drawbacks depending on whether it’s a new denomination or a new type of currency altogether. The following are a few probable advantages and disadvantages:

Advantages:

- Modernization and Security: Updated security features and designs are frequently included into new money, making it more secure and difficult to counterfeit. This increases confidence in the financial system and the currency.

- Efficient Transactions: Improved durability may be built into new money, extending its useful life. This may lower the price of printing, distributing, and replacing worn-out or damaged money.

- Anti-Inflation Measures: By revaluing the currency or altering its denominations, the introduction of a new currency can be a calculated step to combat inflation. Better control over the money supply and price stability may result from this.

- Ease of Use: Transactions can be made more convenient by the introduction of a new denomination or currency design, particularly if it corresponds to typical transaction amounts or simplifies computations.

Disadvantages:

- Transition Costs: The design, printing, distribution, and disposal of old money are all significant expenses when introducing a new currency. Both the government and financial institutions may incur large expenses as a result.

- Confusion and Inconvenience: The public, companies, and financial institutions may become confused when switching to a new currency, which can create delays and errors in transactions as everyone gets used to the shift.

- Resistance and Opposition: Because they are accustomed to and attached to the current currency, people may fight the change. The introduction of a new currency may raise worries about potential disruptions and uncertainty.

- Potential for Speculation: As investors and speculators attempt to predict how the introduction of a new currency would affect the economy and financial markets, this can lead to possibilities for speculation and market volatility.

- Public Education and Awareness: To properly teach the public about the new money, its security features, and its worth, education and awareness efforts are required. Inadequate public education might result in misunderstandings and abuse.

In order to achieve a seamless transition and little disruption to the public and economy, the choice to adopt a new currency should be thoroughly assessed, taking into account the general economic backdrop, potential advantages, and downsides.

To make sure a new currency is safe, attractive, and useful for the goals it is meant for, several crucial components must be carefully taken into account while developing it. These components generally consist of:

- Security Features:

- Watermarks: Complex patterns or pictures pressed into paper during production.

Security Threads: Embedded, challenging-to-replicate threads.

Specialized reflective elements that are challenging to copy include holograms and foils.

Microprinting: Tiny text or designs that require magnification to be seen.

Color-Shifting Ink: Ink that changes hue depending on the angle at which it is seen.

- Watermarks: Complex patterns or pictures pressed into paper during production.

- Design and Aesthetics:

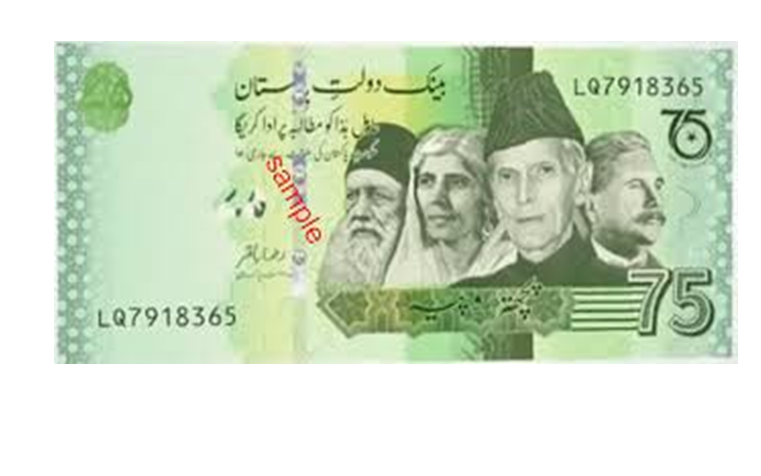

- Images and portraits: Representations of famous people, historical moments, icons, or architectural structures.

Backgrounds & Patterns: Distinctive backgrounds or patterns that improve the appearance of the currency and discourage counterfeiting.

Complex, challenging-to-replicate boundaries for increased security and aesthetics.

Color scheme: A recognizable color scheme that is eye-catching and supports a country’s cultural or historical identity.

- Images and portraits: Representations of famous people, historical moments, icons, or architectural structures.

A multifaceted strategy is required when creating new money, taking into account factors including accessibility, security, durability, and cultural importance. To establish a viable and trustworthy money, professionals in design, security, printing technology, and public perception must work together.